Payment behavior is a crucial aspect of managing cash flow, yet it varies dramatically within the food and beverage industry. At Wholesail, we work with over 300 food service vendors across dozens of categories within this sector, providing us with unique insights into these patterns. This post explores how differently buyers pay their vendors based on what those vendors sell.

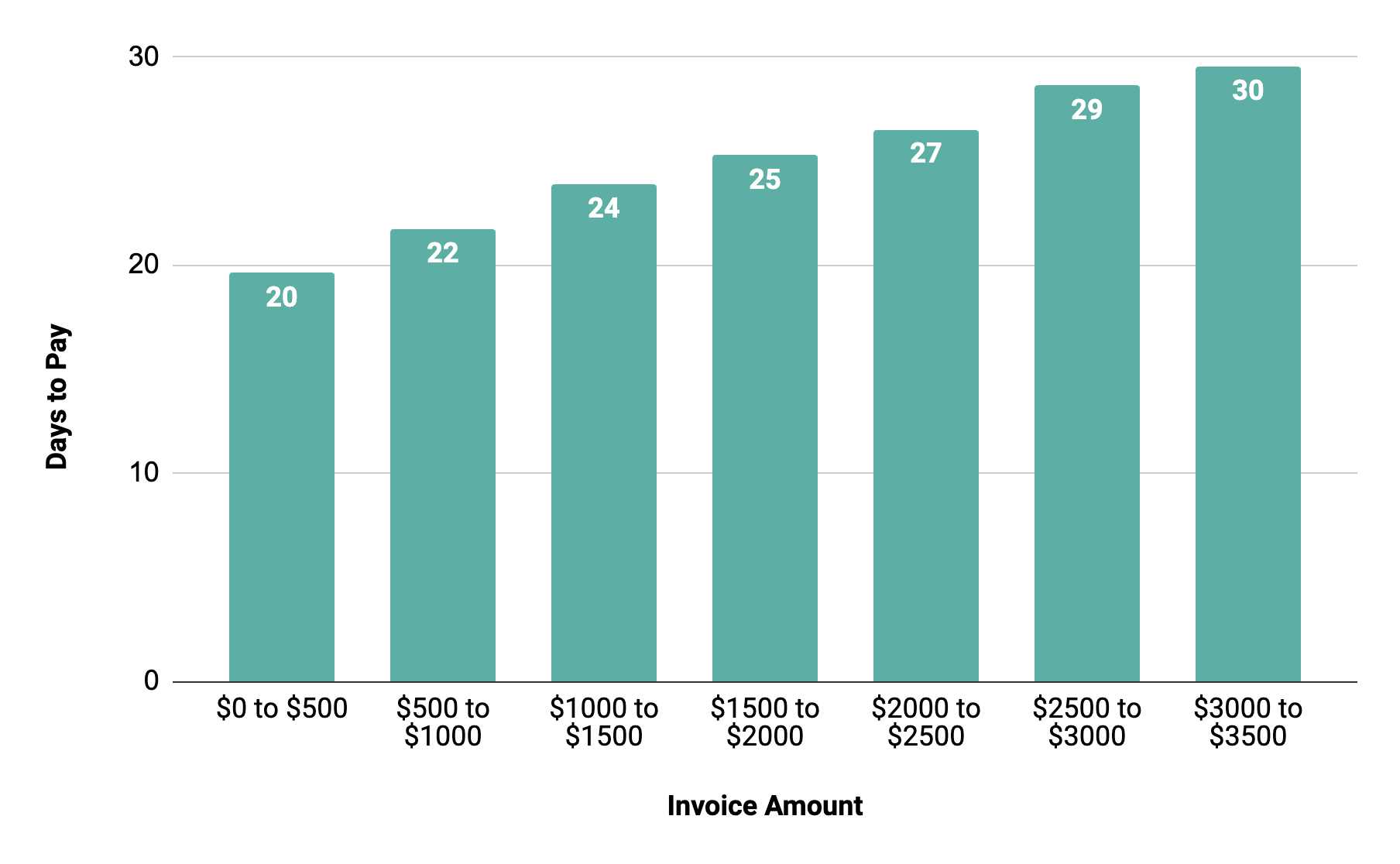

Days to pay across all payment methods (e.g. Check, ACH, Wholesail, Credit Card, other)

Why produce distributors get paid 9 days before meat distributors

- Produce distributors get paid the fastest of any category of food vendor - 18 days. On average this is only 2 days late.

- Meat distributors get paid the slowest - 27 days, 50% longer than produce distributors. On average this is 15 days late.

There are a few key differences between produce & meat purchases:

- Invoice size: The average meat invoice is 7 times larger than the average produce invoice.

- Perishability - Produce is more perishable than meat - it’s ordered on average 8 times per month compared to 5 for meat.

For a restaurant or retail store buying produce - they are going to generate revenue from that produce in days while frozen meat might take weeks to use. The longer working capital cycle for these products means they need to pay slower to manage their cash flow.

Similar reasons can help explain why craft brewery invoices are paid 12 days faster than wine & spirits invoices:

- Craft brewery invoices average $480 and are paid in 17 days while wine & spirits invoices average $1,000 and 29 days to be paid

- Similar to the comparison between produce & meat - beer (especially when in kegs) is turned into sales much faster than wine & spirits.

How important is invoice size?

Invoice size explains a lot of these differences between vendors, though not all (we’ll explore other factors in future blog posts). Across the 300+ Wholesail vendors, the average $300 invoice is paid in 20 days while the average $3,000 invoice is paid in 30 days:

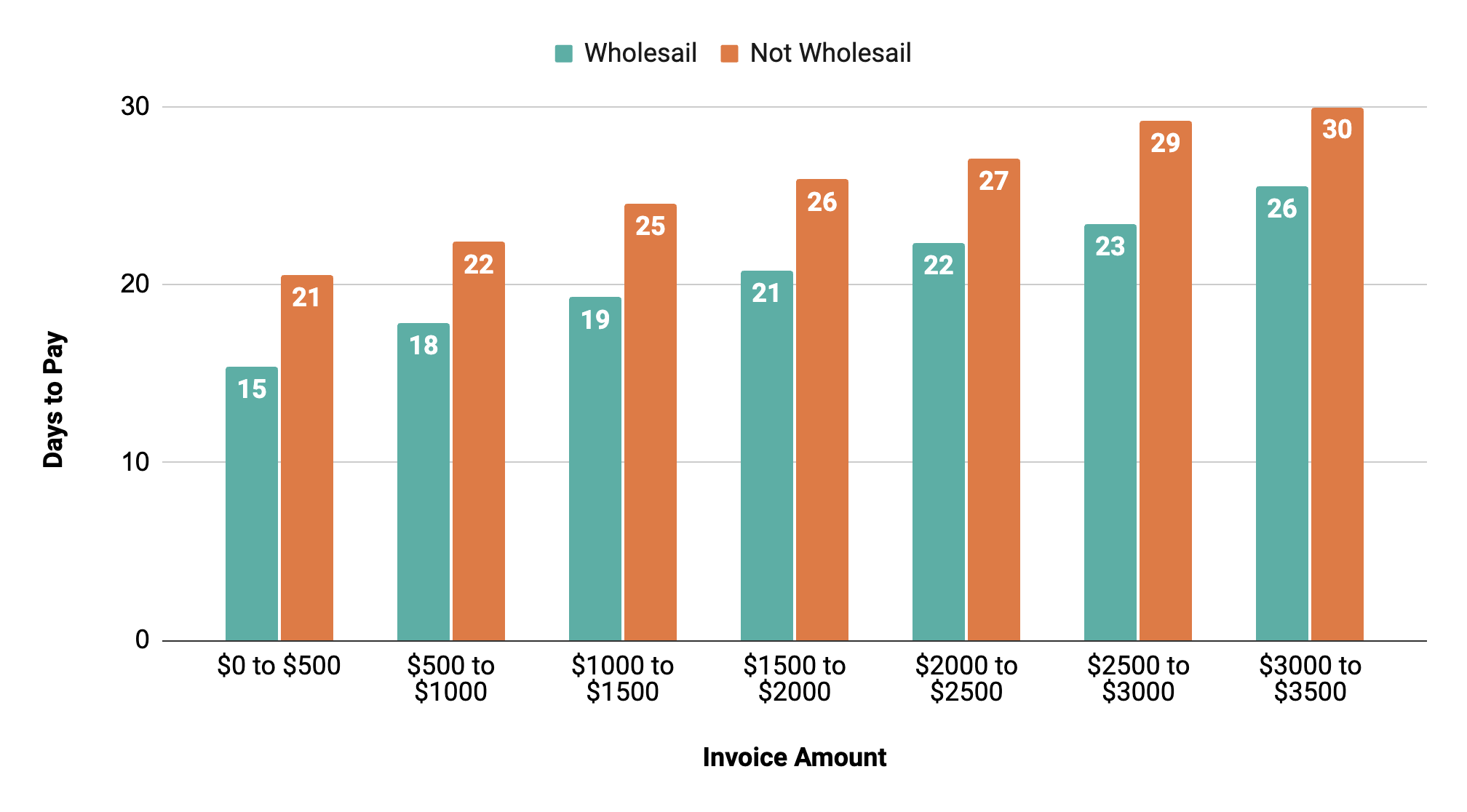

What’s the impact of Wholesail:

When buyers pay via Wholesail, they pay faster across invoice sizes (see chart below). For example, for an invoice that ranges between $2,500-3000, a buyer paying through Wholesail pays in ~23 days vs. 29 days with other payment methods.

Buyers pay faster via Wholesail for a few key reasons:

- Automated statements and easy-to-access payment portal means fewer skipped and lost invoices

- Autopay eliminates the chance a customer pays late and gets them to consistently pay within terms or early

- Tools for the AR team enables them to drive collections and encourage adoption of autopay

Takeaways for a vendor in the food & beverage industry

Understanding these dynamics helps vendors benchmark their customers’ payment behavior and set realistic terms. For example:

- Vendors with smaller invoices and highly perishable goods can expect faster payments but should still monitor buyers for signs of delayed payments.

- Vendors dealing with larger invoices or non-perishable goods should consider offering longer terms to accommodate buyers’ working capital cycles while closely managing late payments.

Coming up next in the series

Future posts will dive deeper into specific industries, explore regional differences, and highlight best practices for improving payment behavior. For example, we’ll analyze why certain segments, like meat distributors, tend to have higher payment delays and how businesses can address these challenges.

Stay tuned as we continue to uncover valuable insights that can help your business thrive in a competitive landscape. If you’re interested in personalized data or want to share your experiences, reach out to us at Wholesail.

Eli Chait

Eli Chait